The FinServ industry is undergoing a major transformation, driven by emerging technologies that enhance efficiency, security, and customer experience. At the heart of these innovations is real-time data streaming, enabled by Apache Kafka and Apache Flink. These technologies allow financial institutions to process and analyze data instantly to make finance smarter, more secure, and more accessible. This blog post explores the top 10 emerging financial technologies and how data streaming plays a critical role in making them a reality.

Join the data streaming community and stay informed about new blog posts by subscribing to my newsletter and follow me on LinkedIn or X (former Twitter) to stay in touch. And make sure to download my free book about data streaming use cases across all industries.

Data Streaming in the FinServ Industry

This article builds on FinTechMagazine.com’s “Top 10 Emerging Technologies in Finance“ by mapping each of these innovations to real-time data streaming concepts, possibilities, and real-world success stories.

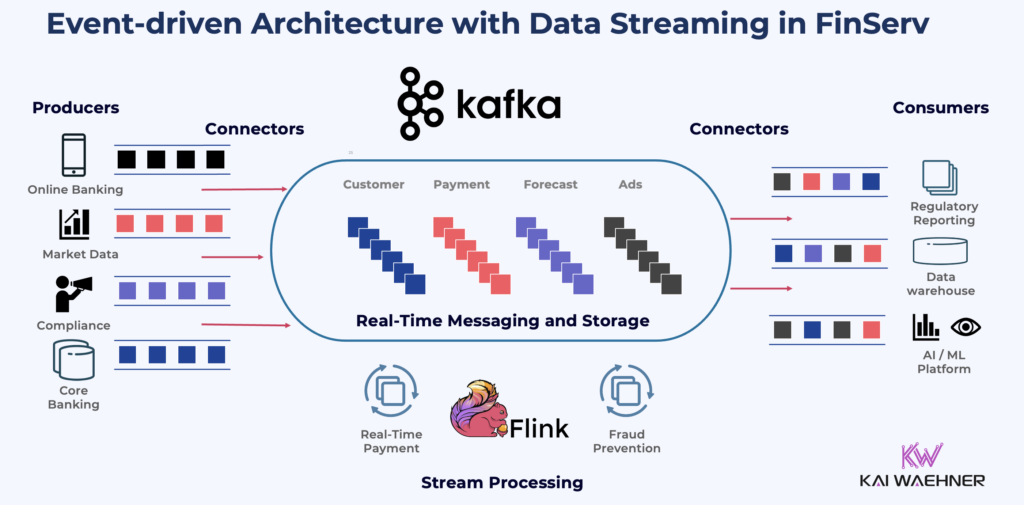

By leveraging Apache Kafka and Apache Flink, financial institutions can process transactions instantly, detect fraud proactively, and enhance customer experiences with real-time insights. Each emerging technology—whether IoT payment networks, AI-powered banking, or embedded finance—relies on the ability to stream, analyze, and act on data in real time, making data streaming a foundational enabler of the future of finance.

10. IoT Payment Networks: Real-time Processing for Seamless Payments

IoT payment networks enable automated, contactless transactions using connected devices like smartwatches, cars, and home appliances. Whether it’s a fridge restocking groceries or a car paying for tolls, these interactions generate massive real-time data streams that must be processed instantly and securely.

How Data Streaming with Kafka and Flink Adds Value

- Fraud Detection in Milliseconds – Flink analyzes streaming transaction data to detect anomalies, flagging fraudulent activity before payments are approved.

- Reliable Connectivity – Kafka ensures payment events from IoT devices are securely transmitted and processed, preventing dropped or duplicate transactions.

- Dynamic Pricing & Offers – Flink processes sensor and market data to adjust prices dynamically (e.g., surge pricing for EV charging stations) and deliver real-time personalized discounts.

- Edge Processing for Low-Latency Payments – Kafka enables local transaction validation on IoT devices, reducing lag in autonomous vehicle payments and retail checkout systems.

- Compliance & Security – Streaming pipelines support real-time monitoring, encryption, and anomaly detection, ensuring IoT payments meet financial regulations like PSD2 and PCI DSS.

In financial services, don’t make the mistake of only looking inward for lessons—other industries have been solving similar challenges for years. Consumer IoT and Apache Kafka have long been used together in sectors like retail, where real-time data integration is critical for unified commerce, rewards programs, social selling, and many other use cases.

9. Voice-First Banking: Turning Conversations into Transactions

Voice-first banking enables customers to interact with financial services using smart speakers, virtual assistants, and mobile voice recognition. Whether checking an account balance, making a payment, or applying for a loan, these interactions require instant access to multiple backend systems—from core banking and CRM to fraud detection and credit scoring systems.

To make voice banking seamless, fast, and secure, banks must integrate real-time data streaming between AI-powered voice assistants and backend financial systems. This is where Apache Kafka and Apache Flink come in.

How Data Streaming with Kafka and Flink Adds Value

- Seamless Integration Across Banking Systems – Voice assistants need real-time access to core banking (account balances, transactions), CRM (customer history), risk systems (fraud checks), and AI analytics. Kafka acts as a high-speed messaging and integration layer (aka ESB/middleware), ensuring that voice requests are instantly routed to the right backend services (including legacy technologies, such as mainframe) and responses are processed in milliseconds.

- Instant Voice Query Processing – When a customer asks, “What’s my balance?”, Flink streams real-time transaction data from Kafka to retrieve the latest balance, rather than relying on outdated batch data.

- Secure Authentication & Fraud Detection – Streaming pipelines analyze voice patterns in real time to detect fraud and trigger multi-factor authentication (MFA) if needed.

- Personalized & Context-Aware Banking and Advertising – Flink continuously enriches customer profiles by analyzing past transactions, spending habits, and preferences—allowing the system to offer real-time financial insights (e.g., suggesting a savings plan based on spending trends).

- Asynchronous Processing for Long-Running Requests – For complex tasks like loan applications, Kafka handles asynchronous processing—initiating background workflows across multiple systems while keeping the customer engaged.

For instance, Northwestern Mutual presented at Kafka Summit how the bank leverages Apache Kafka as a database for real-time transaction processing.

8. Autonomous Finance Platforms: AI-Driven Financial Decision Making

Autonomous finance platforms use AI, machine learning, and multi-agent systems to optimize savings, investments, and budgeting for consumers. These platforms act as digital financial advisors to make real-time decisions based on market data, user spending habits, and risk models.

How Data Streaming with Kafka and Flink Adds Value

- Multi-Agent AI System Coordination – Autonomous finance platforms use multiple AI agents to handle different aspects of financial decision-making (e.g., portfolio optimization, credit assessment, fraud detection). Kafka streams data between these AI agents, ensuring they can collaborate in real time to refine investment and savings strategies.

- Streaming Market Data Integration – Kafka ingests live stock prices, interest rates, and macroeconomic data, making it instantly available for AI models to adjust financial strategies.

- Real-Time Customer Insights – Flink continuously analyzes customer transactions and spending behavior to enable AI-driven recommendations (e.g., automatically moving surplus funds into an interest-bearing account).

- Predictive Portfolio Management – By combining real-time stock market data with AI-driven risk models, Flink helps adjust portfolio allocations based on current trends, ensuring maximum returns while minimizing exposure.

- Automated Risk Mitigation – Autonomous finance systems must react instantly to market shifts. Flink’s real-time monitoring detects economic downturns or sudden market crashes, triggering immediate adjustments to investment portfolios or loan interest rates.

- Event-Driven Financial Automation – Kafka enables real-time triggers (e.g., an AI agent detecting high inflation can automatically adjust a savings strategy).

7. RegTech 3.0: Automating Compliance and Risk Monitoring

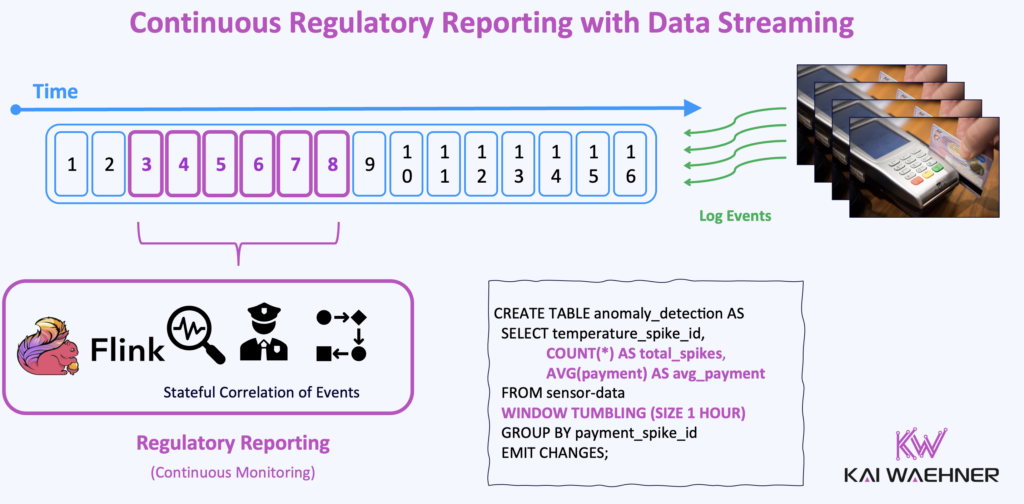

RegTech is modernizing compliance by replacing slow batch audits with continuous real-time monitoring, automated reporting, and proactive fraud detection.

Financial institutions need instant insights into transactions, risk exposure, and regulatory changes—Kafka and Flink make this possible by streaming, analyzing, and automating compliance at scale.

How Data Streaming with Kafka and Flink Adds Value

- Continuous Transaction Monitoring – Kafka streams every transaction in real time, enabling Flink to detect fraud, money laundering, or unusual patterns instantly—ensuring compliance with AML and KYC regulations.

- Automated Regulatory Reporting – Flink processes compliance events as they happen, ensuring regulatory bodies receive up-to-date reports without delays. Kafka integrates compliance data across banking systems for audit-ready records.

- Real-Time Fraud Prevention – Flink analyzes transaction behavior in milliseconds, detecting anomalies and triggering security actions like transaction blocking or multi-factor authentication.

- Event-Driven Compliance Alerts – Kafka ensures instant alerts when regulations change, allowing banks to adapt in real time instead of relying on manual updates.

- Proactive Risk Management – By analyzing live risk factors across transactions, users, and markets, Flink helps financial institutions identify and prevent compliance violations before they occur.

For example, KOR leverages data streaming to revolutionize compliance and regulatory reporting in the derivatives market by enabling on-demand historical reporting and real-time insights that were previously difficult to achieve with traditional batch processing. By using Kafka as a persistent state store, KOR ensures an immutable log of data that allows regulators to track changes over time, reconcile historical corrections, and meet compliance requirements more efficiently than legacy ETL-based big data systems. Read the entire KOR success story in my ebook.

6. Central Bank Digital Currencies (CBDC): The Future of Government-Backed Digital Money

Central Bank Digital Currencies (CBDC) are digital versions of national currencies, designed to enable faster, more secure, and highly scalable financial transactions.

Unlike cryptocurrencies, CBDCs are government-backed, meaning they require robust, real-time infrastructure capable of handling millions of transactions per second. They also need instant settlement, fraud detection, and cross-border interoperability—all of which depend on real-time data streaming.

How Data Streaming with Kafka and Flink Adds Value

- Instant Settlement – Kafka ensures that CBDC transactions are processed and confirmed in real time, eliminating delays in digital payments. This allows central banks to enable 24/7 instant transactions, even in cross-border scenarios.

- Scalability for Nationwide Adoption – Flink dynamically processes millions of transactions per second, ensuring that a CBDC system can handle high demand without bottlenecks or downtime.

- Cross-Border Payments & Exchange Rate Optimization – Flink analyzes foreign exchange markets in real time and ensures optimized B2B data exchange for currency conversion and detecting suspicious cross-border activities for fraud prevention.

- Regulatory Monitoring & Compliance – Kafka continuously streams transaction data to regulatory bodies. This ensures governments have real-time visibility into the movement of digital currencies.

At Kafka Summit Bangalore 2024, Mindgate Solutions presented its successful integration of Central Bank Digital Currency (CBDC) into banking apps, leveraging real-time data streaming to enable seamless digital payments. Mindgate utilized Kafka-based microservices architecture to ensure scalability, security, and reliability, reinforcing its leadership in India’s real-time payments ecosystem while processing over 8 billion transactions per month.

5. Green Fintech Infrastructure: Sustainability and ESG in Finance

Green fintech focuses on tracking carbon footprints, ESG (Environmental, Social, and Governance) investments, and climate risks in real time.

As financial institutions shift towards sustainable investment strategies, they need accurate, real-time data on environmental impact, regulatory compliance, and green investment opportunities.

How Data Streaming with Kafka and Flink Adds Value

- Real-Time Carbon Tracking – Kafka streams emissions and sustainability data from supply chains to enable instant carbon footprint analysis.

- Automated ESG Compliance – Flink analyzes sustainability reports and investment portfolios, automatically flagging non-compliant companies or assets.

- Green Investment Insights – Real-time analytics match investors with eco-friendly projects, funds, and companies, helping financial institutions promote sustainable investments.

More details about optimizing the ESG footprint with data streaming: “Green Data, Clean Insights: How Kafka and Flink Power ESG Transformations“.

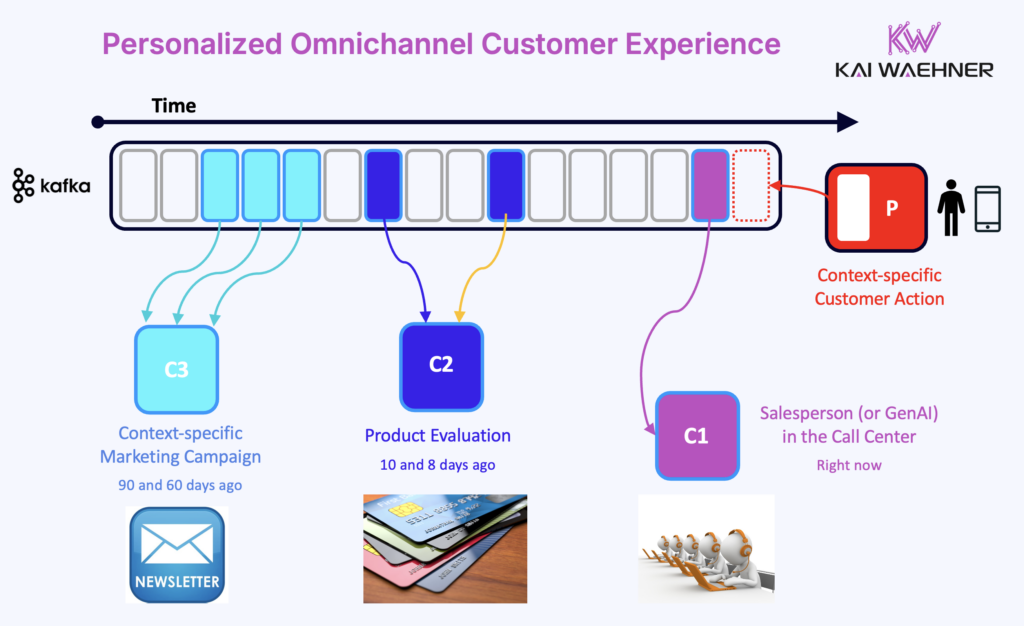

4. AI-Powered Personalized Banking: Hyper-Personalized Customer Experiences

AI-driven banking solutions are transforming how customers interact with financial institutions to provide real-time insights, spending recommendations, and fraud alerts based on user behavior.

How Data Streaming with Kafka and Flink Adds Value

- Real-Time Spending Analysis – Flink continuously processes live transaction data, identifying spending patterns to provide instant budgeting recommendations.

- Personalized Alerts & Recommendations – Kafka streams transaction events to banking apps, notifying users of unusual spending, low balances, or savings opportunities.

- Automated Financial Planning – Flink enables AI-driven financial assistance, helping users optimize savings, credit usage, and investments based on real-time insights.

A good example is how Erste Group Bank modernized its mobile banking experience with a hyper-personalized approach to ensure that customers receive tailored financial insights while prioritizing data consistency over real-time updates. By offloading data from expensive mainframes to a cloud-native, microservices-driven architecture, Erste Group Bank reduced costs, maintained compliance, and improved operational efficiency—ensuring a seamless flow of consistent, high-quality data across its legacy and modern banking applications. Read the entire Erste Group Bank success story in my ebook.

3. Decentralized Identity Solutions: Secure Identity Without Central Authorities

Decentralized identity solutions allow users to control their personal data, eliminating the need for centralized databases that are vulnerable to hacks. These systems use blockchain and zero-knowledge proofs for secure, passwordless authentication, but require real-time verification and fraud prevention measures.

How Data Streaming with Kafka and Flink Adds Value

- Cybersecurity in Real Time – Kafka streams biometric and identity verification data to fraud detection engines, ensuring instant risk analysis.

- Passwordless Authentication – Kafka integrates blockchain and biometric authentication to enable real-time identity validation without traditional passwords.

- Secure KYC (Know Your Customer) Processing – Flink processes identity verification requests instantly, ensuring faster onboarding and fraud-proof financial transactions.

2. Quantum-Resistant Cryptography: Securing Financial Data in the Quantum Era

Quantum computing poses a major risk to traditional encryption methods, requiring financial institutions to adopt post-quantum cryptography to secure sensitive financial transactions and user data.

How Data Streaming with Kafka and Flink Adds Value

- Scalable Cryptographic Upgrades – Streaming data pipelines allow banks to deploy cryptographic updates instantly, ensuring financial systems remain secure without downtime.

- Threat Detection & Security Analysis – Flink analyzes live transaction patterns to identify potential vulnerabilities in encryption algorithms before they are exploited.

Nobody knows where quantum computing goes. Frankly, this is the only section of the top 10 finance innovations where I am not sure how much data streaming will be able to help or if completely new paradigms come up.

1. Embedded Finance: Banking Services in Every Digital Experience

Embedded finance integrates banking, payments, lending, and insurance into non-financial platforms, allowing companies like Uber, Shopify, and Apple to offer seamless financial services within their ecosystems.

To function smoothly, embedded finance requires real-time data integration between payment processors, credit scoring systems, fraud detection tools, and regulatory bodies.

How Data Streaming with Kafka and Flink Adds Value

- Instant Payments & Transactions – Kafka streams payment data in real time, enabling seamless in-app purchases and instant money transfers.

- Real-Time Credit Scoring & Lending – Flink analyzes transaction histories to provide instant credit approvals for loans and BNPL (Buy Now, Pay Later) services.

- Fraud Prevention & Compliance – Streaming analytics detect suspicious behavior in real time, ensuring secure embedded financial transactions.

Tech giants like Uber and Shopify have embedded financial services directly into their platforms using event-driven architectures powered by Kafka, enabling real-time payments, lending, and fraud detection. By integrating finance seamlessly into their ecosystems, these companies enhance customer experience, create new revenue streams, and redefine how consumers interact with financial services.

Just like Uber and Shopify use event-driven architectures for real-time payments and financial services, Stripe and many similar FinTech companies power embedded finance for businesses by providing seamless, scalable payment infrastructure. To ensure six-nines (99.9999%) availability, Stripe relies on Apache Kafka as its financial source of truth to enable ultra-reliable transaction processing and real-time financial insights.

The Future of FinServ Is Real-Time: Are You Ready for Data Streaming?

The future of finance is real-time, intelligent, and seamlessly integrated into digital ecosystems. The ability to process massive amounts of financial data instantly is no longer optional—it’s a competitive necessity for operational and analytical use cases.

Data streaming with Apache Kafka and Apache Flink provides the foundation for scalability, security, and real-time analytics that modern financial services demand. By embracing data streaming, financial institutions can deliver:

- Faster transactions

- Proactive fraud prevention

- Better customer experiences

- Regulatory compliance

Finance is evolving from batch processing to real-time intelligence—and the companies that adopt streaming-first architectures will lead the industry into the future.

How do you leverage data streaming with Kafka and Flink in financial services? Let’s discuss on LinkedIn or X (former Twitter). Also join the data streaming community and stay informed about new blog posts by subscribing to my newsletter and to stay in touch. And make sure to download my free book about data streaming use cases across all industries.