Mobility services like Uber, Grab, FREE NOW (Lyft), and DoorDash are built on real-time data. Every trip, delivery, and payment relies on accurate, instant decision-making. But as these services scale, they become prime targets for sophisticated fraud—GPS spoofing, fake accounts, payment abuse, and more. Traditional, batch-based fraud detection can’t keep up. It reacts too late, misses complex patterns, and creates blind spots that fraudsters exploit. To stop fraud before it happens, mobility platforms need data streaming technologies like Apache Kafka and Apache Flink for fraud detection. This blog explores how leading platforms are using real-time event processing to detect and block fraud as it happens—protecting revenue, user trust, and platform integrity at scale.

Join the data streaming community and stay informed about new blog posts by subscribing to my newsletter and follow me on LinkedIn or X (former Twitter) to stay in touch. And make sure to download my free book about data streaming use cases.

The Business of Mobility Services (Ride-Hailing, Food Delivery, Taxi Aggregators, etc.)

Mobility services have become an essential part of modern urban life. They offer convenience and efficiency through ride-hailing, food delivery, car-sharing, e-scooters, taxi aggregators, and micro-mobility options. Companies such as Uber, Lyft, FREE NOW (former MyTaxi; acquired by Lyft recently), Grab, Careem, and DoorDash connect millions of passengers, drivers, restaurants, retailers, and logistics partners to enable seamless transactions through digital platforms.

These platforms operate in highly dynamic environments where real-time data is crucial for pricing, route optimization, customer experience, and fraud detection. However, this very nature of mobility services also makes them prime targets for fraudulent activities. Fraud in this sector can lead to financial losses, reputational damage, and deteriorating customer trust.

To effectively combat fraud, mobility services must rely on real-time data streaming with technologies such as Apache Kafka and Apache Flink. These technologies enable continuous event processing and allow platforms to detect and prevent fraud before transactions are finalized.

Why Fraud is a Major Challenge in Mobility Services

Fraudsters continually exploit weaknesses in digital mobility platforms. Some of the most common fraud types include:

- Fake Rides and GPS Spoofing: Drivers manipulate GPS data to simulate trips that never occurred. Passengers use location spoofing to receive cheaper fares or exploit promotions.

- Payment Fraud and Stolen Credit Cards: Fraudsters use stolen payment methods to book rides or order food.

- Fake Drivers and Passengers: Fraudsters create multiple accounts and pretend to be both the driver and passenger to collect incentives. Some drivers manipulate fares by manually adjusting distances in their favor.

- Promo Abuse: Users create multiple fake accounts to exploit referral bonuses and promo discounts.

- Account Takeovers and Identity Fraud: Hackers gain access to legitimate accounts, misusing stored payment information. Fraudsters use fake identities to bypass security measures.

Fraud not only impacts revenue but also creates risks for legitimate users and drivers. Without proper fraud prevention measures, ride-hailing and delivery companies could face serious losses, both financially and operationally.

The Unseen Enemy: Core Challenges in Mobility Fraud

Detection

Traditional fraud detection relies on batch processing and manual rule-based systems. However, these approaches are no longer effective due to the speed and complexity of modern mobile apps with real-time experiences combined with modern fraud schemes.

Key challenges in mobility fraud detection include:

- Fraud occurs in real-time, requiring instant detection and prevention before transactions are completed.

- Millions of events per second must be processed, requiring scalable and efficient systems.

- Fraud patterns constantly evolve, making static rule-based approaches ineffective.

- Platforms operate across hybrid and multi-cloud environments, requiring seamless integration of fraud detection systems.

How Data Streaming with Apache Kafka and Flink Enables Real-Time Fraud Detection

To overcome these challenges, real-time streaming analytics powered by Apache Kafka and Apache Flink provide an effective solution.

Apache Kafka: The Backbone of Event-Driven Fraud Detection

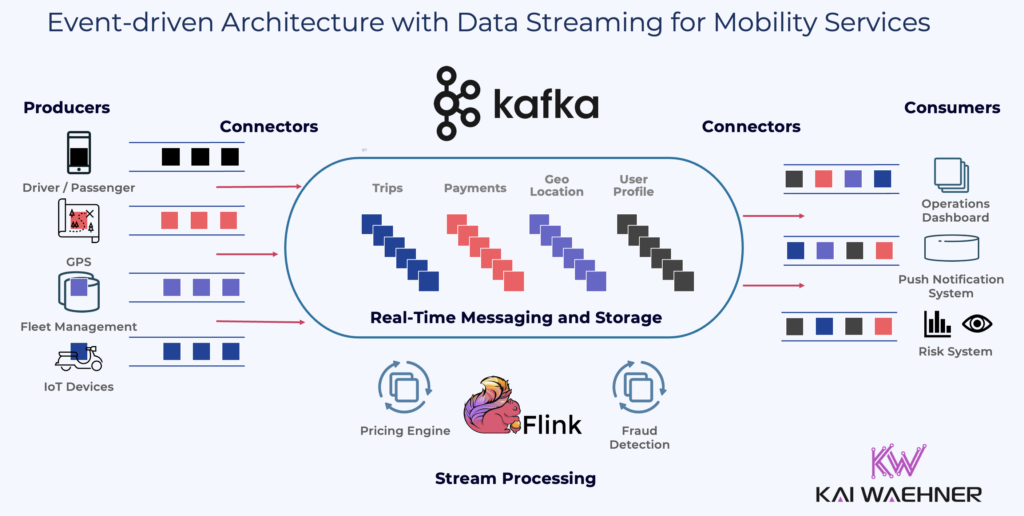

Kafka serves as the core event streaming platform. It captures and processes real-time data from multiple sources such as:

- GPS location data

- Payment transactions

- User and driver behavior analytics

- Device fingerprints and network metadata

Kafka provides:

- High-throughput data streaming, capable of processing millions of events per second to support real-time decision-making.

- An event-driven architecture that enables decoupled, flexible systems—ideal for scalable and maintainable mobility platforms.

- Seamless scalability across hybrid and multi-cloud environments to meet growing demand and regional expansion.

- Always-on reliability, ensuring 24/7 data availability and consistency for mission-critical services such as fraud detection, pricing, and trip orchestration.

An excellent success story about the transition to data streaming comes from DoorDash: Why DoorDash migrated from Cloud-native Amazon SQS and Kinesis to Apache Kafka and Flink.

Apache Flink: Continuous Stream Processing for Fraud Detection in Real-Time

Apache Flink enables real-time fraud detection through advanced event correlation and applied AI:

- Detects anomalies in GPS data, such as sudden jumps, route manipulation, or unrealistic movement patterns.

- Analyzes historical user behavior to surface signs of account takeovers or other forms of identity misuse.

- Joins multiple real-time streams—including payment events, location updates, and account interactions—to generate accurate, low-latency fraud scores.

- Applies machine learning models in-stream, enabling the system to flag and stop suspicious transactions before they are processed.

- Continuously adapts to new fraud patterns, updating models with fresh data in near real-time to reflect evolving user behavior and emerging threats.

With Kafka and Flink, fraud detection can shift from reactive to proactive to stop fraudulent transactions before they are completed.

I already covered various data streaming success stories from financial services companies such as Paypal, Capital One and ING Bank in a dedicated blog post. And a separate case study from about “Fraud Prevention in Under 60 Seconds with Apache Kafka: How A Bank in Thailand is Leading the Charge“.

Real-World Fraud Prevention Stories from Mobility Leaders

Fraud is not just a technical issue—it’s a business-critical challenge that impacts trust, revenue, and operational stability in mobility services. The following real-world examples from industry leaders like FREE NOW (Lyft), Grab, and Uber show how data streaming with advanced stream processing and AI are used around the world to detect and stop fraud in real time, at massive scale.

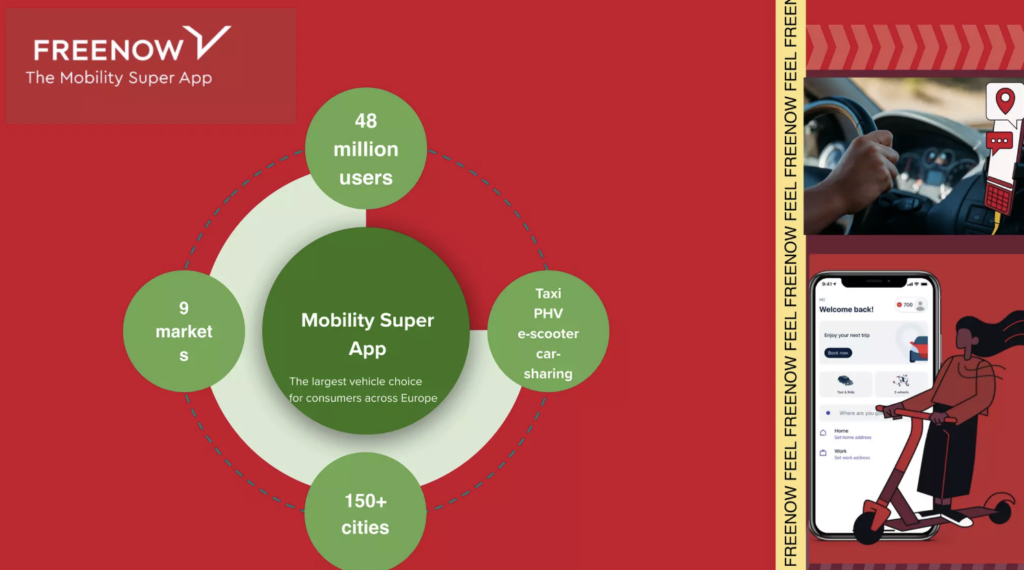

FREE NOW (Lyft): Detecting Fraudulent Trips in Real Time by Analyzing GPS Data of Cars

FREE NOW operates in more than 150 cities across Europe with 48 million users. It integrates multiple mobility services, including taxis, private vehicles, car-sharing, e-scooters, and bikes.

The company was recently acquired by Lyft, the U.S.-based ride-hailing giant known for its focus on multimodal urban transport and strong presence in North America. This acquisition marks Lyft’s strategic entry into the European mobility ecosystem, expanding its footprint beyond the U.S. and Canada.

Fraud Prevention Approach leveraging Data Streaming (presented at Kafka Summit)

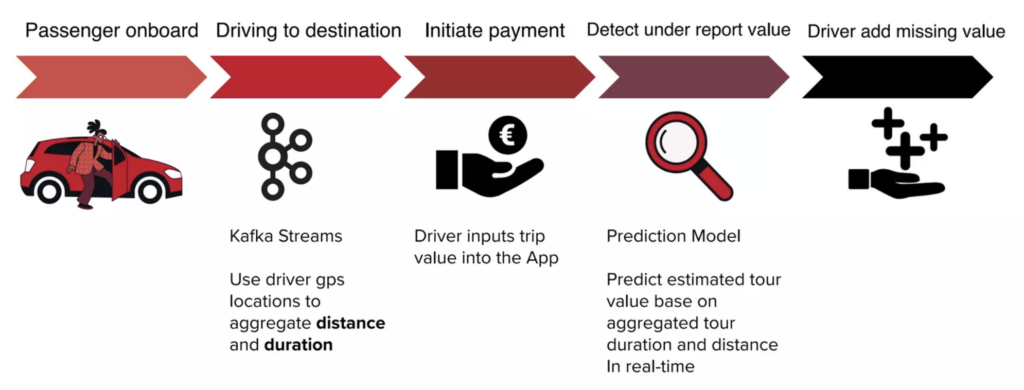

- Uses Kafka Streams and Kafka Connect to analyze GPS trip data in real-time.

- Deploys fraud detection models that identify anomalies in trip routes and fare calculations.

- Operates data streaming on fully managed Confluent Cloud and applications on Kubernetes for scalable fraud detection.

Example: Detecting Fake Rides

- A driver inputs trip details into the app.

- Kafka Streams predicts expected trip fare based on distance and duration.

- GPS anomalies and unexpected route changes are flagged.

- Fraud alerts are triggered for suspicious transactions.

By implementing real-time fraud detection with Kafka and Flink, FREE NOW (Lyft) has significantly reduced fraudulent trips and improved platform security.

Grab: AI-Powered Fraud Detection for Ride-Hailing and Delivery with Data Streaming and AI/ML

Grab is a leading mobility platform in Southeast Asia, handling millions of transactions daily. Fraud accounts for 1.6 percent of total revenue loss in the region.

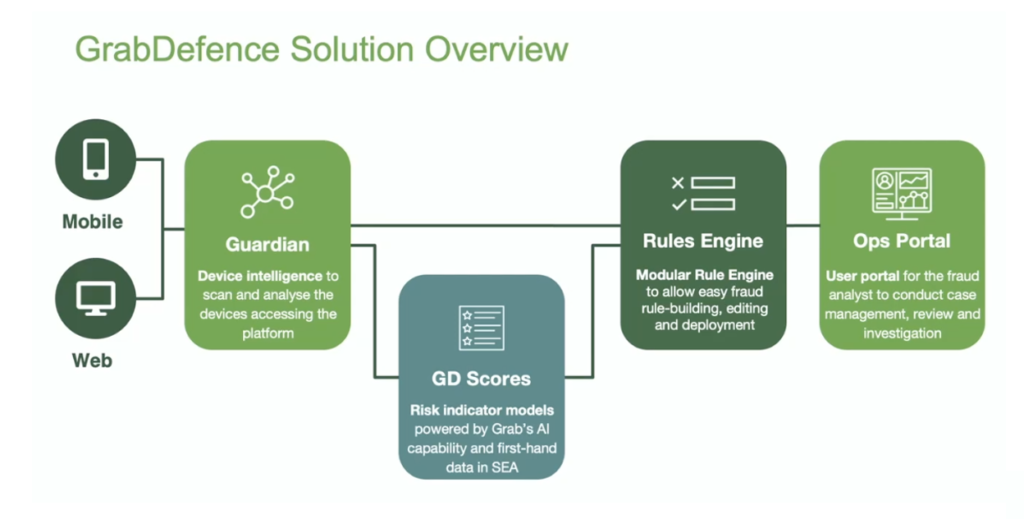

To address these significant fraud numbers, Grab developed GrabDefence—an AI-powered fraud detection engine that leverages real-time data and machine learning to detect and block suspicious activity across its platform.

Fraud Detection Approach

- Uses Kafka Streams and machine learning for fraud risk scoring.

- Leverages Flink for feature aggregation and anomaly detection.

- Detects fraudulent transactions before they are completed.

Example: Fake Driver and Passenger Fraud

- Fraudsters create accounts as both driver and passenger to claim rewards.

- Kafka ingests device fingerprints, payment transactions, and ride data.

- Flink aggregates historical fraud behavior and assigns risk scores.

- High-risk transactions are blocked instantly.

With GrabDefence built with data streaming, Grab reduced fraud rates to 0.2 percent, well below the industry average. Learn more about GrabDefence in the Kafka Summit talk.

Uber: Project RADAR – AI-Powered Fraud Detection with Human Oversight

Uber processes millions of payments per second globally. Fraud detection is complex due to chargebacks and uncollected payments.

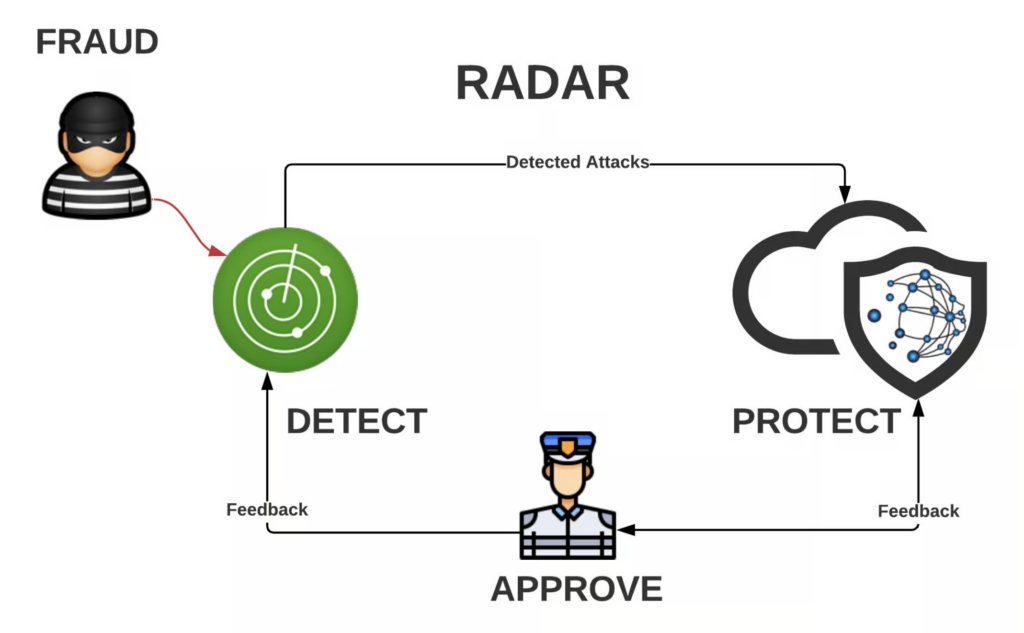

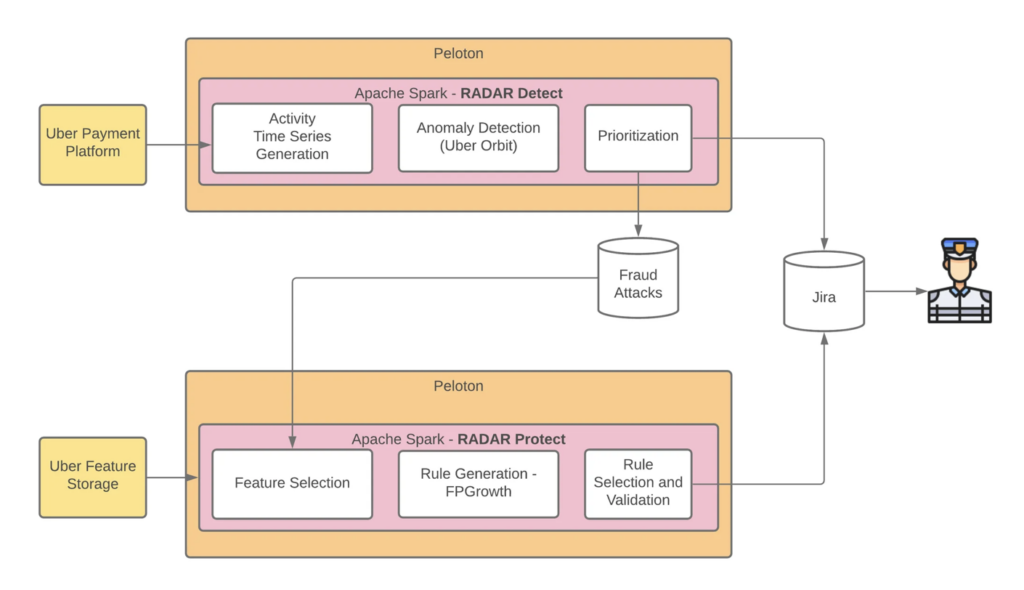

To combat this, Uber launched Project RADAR—a hybrid system that combines machine learning with human reviewers to continuously detect, investigate, and adapt to evolving fraud patterns in near real time. Low latency is not required in this scenario. And humans are in the loop of the business process. Hence, Apache Spark is sufficient for Uber.

Fraud Prevention Approach

- Uses Kafka and Spark for multi-layered fraud detection.

- Implements machine learning models to detect chargeback fraud.

- Incorporates human analysts for rule validation.

Example: Chargeback Fraud Detection

- Kafka collects all ride transactions in real time.

- Stream processing detects anomalies in payment patterns and disputes.

- AI-based fraud scoring identifies high-risk transactions.

- Uber’s RADAR system allows human analysts to validate fraud alerts.

Uber’s combination of AI-driven detection and human oversight has significantly reduced chargeback-related fraud.

Data Streaming with Kafka and Flink Provides Real-Time Fraud Detection in Mobility Services

Fraud in mobility services is a real-time challenge that requires real-time solutions that work 24/7, even at extreme scale for millions of events. Traditional batch processing systems are too slow, and static rule-based approaches cannot keep up with evolving fraud tactics.

By leveraging data streaming with Apache Kafka in conjunction with Kafka Streams or Apache Flink, mobility platforms can:

- Process millions of events per second to detect fraud in real time.

- Prevent fraudulent transactions before they occur.

- Use AI-driven real-time fraud scoring for accurate risk assessment.

- Adapt dynamically through continuous learning to evolving fraud patterns.

Mobility platforms such as Uber, Grab, and FREE NOW (Lyft) are leading the way in using real-time streaming analytics to protect their platforms from fraud. By implementing similar approaches, other mobility businesses can enhance security, reduce financial losses, and maintain customer trust.

Real-time fraud prevention in mobility services is not an option; it is a necessity. The ability to detect and stop fraud in real time will define the future success of ride-hailing, food delivery, and urban mobility platforms.

Stay ahead of the curve! Subscribe to my newsletter for insights into data streaming and connect with me on LinkedIn to continue the conversation. And download my free book about data streaming use cases.